IADA Q1 2025 Report Reflects Strong Transactions, Market Outlook Tempered

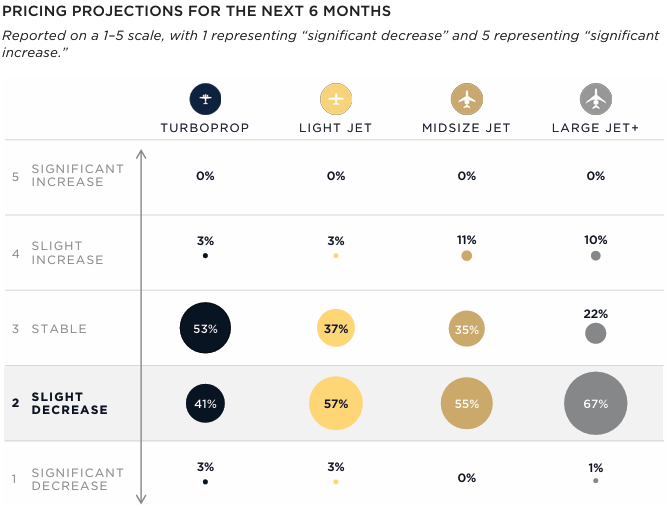

IADA's First Quarter 2025 Market Report forecasts a stable to slight decrease in pricing across all aircraft categories.

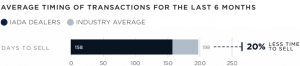

DAYTONA BEACH, FL, UNITED STATES, April 28, 2025 /EINPresswire.com/ -- Members of the International Aircraft Dealers Association (IADA) reported completing 316 aircraft sales transactions in the first quarter of 2025, a 24% increase from 254 deals during the same period last year.

According to IADA’s First Quarter 2025 Market Report, while sales activity remained robust, members expressed a more cautious market outlook due to continued economic uncertainties. The data and insights in the report were compiled before global stock markets experienced recent tariff-driven volatility in April.

In the first 90 days of 2025, IADA dealers had 250 aircraft under contract, compared to the 251 recorded at the end of the first quarter of 2024. Exclusive contracts to sell dropped from 304 in the first quarter of 2024 to 203 in the first quarter just ended, reflecting more of a buyers' market.

“Although aircraft pricing has held steady, our members are voicing a more reserved outlook compared to the high confidence levels we saw at the end of 2024,” said Lou Seno, Executive Director of IADA. “The six-month forecast reflects a tempered approach as dealers navigate broader economic uncertainties.”

“IADA dealers remained active in the first quarter, but their sentiment is shifting,” said IADA Chairman Phil Winters, who also serves as VP of Aircraft Sales and Charter Management at Western Aircraft. “While demand continues, the industry is watching global financial trends closely, which are shaping more conservative expectations for the remainder of the year.”

For the full market report, visit Aircraft Exchange.

Market Insights and Forecast

The first quarter survey of IADA members suggests that aircraft pricing is likely to remain stable or experience modest declines across all segments, with turboprops showing the greatest resilience. Light, midsize, and large jets are anticipated to face slightly more pricing pressure.

In terms of inventory, members foresee either a steady or slightly increased supply across most categories, except large jets, where some decline may occur. Dealers also indicated a general trend toward reduced willingness to take on aircraft inventory.

The IADA Market Report stands out for its blend of transactional data and expert insights from IADA members, who collectively handle more aircraft sales by dollar volume than all other dealers worldwide. Nearly 80% of IADA-Accredited Dealers participate in both new and pre-owned aircraft sales.

IADA’s exclusive quarterly surveys monitor key market indicators, including supply, demand, pricing trends, and willingness to inventory aircraft across the turboprop, light, midsize, and large and ultra-long-range jet categories.

Industry Perspectives from IADA Members

“The questionable tariff tactics by Trump are creating market volatility and uncertainty in the marketplace.” — Geoffrey Carlyle, Skyservice Business Aviation Inc.

“It’s very difficult to make six-month predictions in this market. Things are changing rapidly—sometimes daily. Tariff wars are making purchasers insecure. Corporate buyers need to pause and assess how government policies and regulations may affect their bottom line.” — Gregory Cirillo, HCH Legal

“While we’ve seen a rise in inventory and decreasing demand for certain makes and models, other segments continue to experience low inventory, strong demand, and quick absorption rates.” — Scott Oshman, Oshman Aviation

“Like our firm, many brokers I speak with are very busy in Q1 handling buyer and seller interest. Age and near-term maintenance liabilities are major risk factors for a successful sale of a pre-owned aircraft. Buyers are no longer ignoring these variables.” — Shawn Dinning, Dallas Jet International

“It’s a difficult time to predict market conditions. Our industry’s health depends significantly on the recent tariffs imposed by the Trump administration. It remains unclear whether these tariffs will stay in place and how they will ultimately affect business aviation.” — Jeff Dunn, JA Mitsui Leasing Capital Corporation

“We saw 2025 start with renewed vigor, in contrast to the ‘wait-and-see’ approach that characterized the second half of 2024. Transaction activity is strong worldwide, especially in the U.S., the Middle East, Latin America, and Europe. However, tariff discussions could shift market conditions significantly in key regions.” — Zipporah Marmor, OPUS Aero

“Things are steady and stable.” — Pat Hosman, Southern Cross Aircraft

“We are seeing a slight pause in the market due to the administration’s initiatives, including stock market fluctuations and interest rates. However, I don’t think these trends will persist for long.” — Andy Toy, Axiom Aviation, Inc.

“Predicting the market over the next several months is challenging. The effects of tariffs, fiscal policy, and other aspects of the new administration’s agenda remain uncertain.” — Carey Friedman, Eagle Aviation

“Buying activity increased following the election, leading to Q1 aircraft closings spilling over from late 2024. Demand has remained steady as the year progresses.” — Emily Deaton, JetAVIVA

“Demand remains solid, particularly for young, pre-owned aircraft. Overall utilization has stabilized, with continued strength in fractional flight operations. As OEM supply chains recover and new production increases, we expect a gradual release of younger inventory from trade-ins.” — Rollie Vincent, Roland Vincent Associates

“The current market remains strong but has softened slightly. We are receiving fewer inquiries, but those we do receive are serious and well-qualified. Unlike 2024, transactions are taking longer to close.” — Eric Roth, International Jet Interiors

“2025 has started sluggishly compared to recent years. Economic uncertainty, including questions surrounding bonus depreciation, has many potential buyers waiting for a clearer picture.” — Toby Smith, JBA Jets

“With supply gradually increasing, sellers may begin to feel pressure on pricing, particularly compared to the 2021-2024 markets. To succeed, sellers must align expectations with current market conditions rather than hoping for past pricing trends.” — Johnny Foster, OGARAJETS

“Later-model aircraft are performing well across all categories. However, older and out-of-production aircraft are seeing slower demand.” — John Odegard, 5X5 Trading

“All eyes are on Washington, D.C. right now. If the new administration successfully implements tax cuts, we could see a significant boost in the aircraft market. Conversely, failure to do so could result in a sharp downturn.” — Frank Janik, Leading Edge Aviation

“Turnover is stabilizing at a low-normal level.” — Hans Doll, Atlas Air Service

“There’s a sense of uncertainty and volatility due to unclear Trump administration policies. Until their economic impact is clearer, some buyers will stay on the sidelines. However, savvy buyers may use this uncertainty to their advantage.” — Mitch Pisko, Honda Aircraft Company

“For the next six to nine months, political uncertainty will be the primary factor influencing market conditions.” — Jon Taylor, JB&A Aviation

“The overall market should remain stable. If 100% depreciation returns, we could see a surge in activity. The uncertainty surrounding this issue may be keeping buyers on the sidelines for now.” — Tyler Bowron, Hatt & Associates

“Market uncertainty is expected to persist due to inflation, tariffs, and global military tensions. These factors will likely dampen aircraft sales in 2025.” — Brent Dahlfors, Jet Transactions

About IADA

The International Aircraft Dealers Association (IADA) is a professional trade organization that sets the standard for excellence in the aircraft resale industry. IADA members are among the most experienced and respected professionals in the field, committed to maintaining the highest levels of integrity, transparency, and expertise. IADA-Accredited Dealers undergo rigorous vetting and continuous re-accreditation, ensuring that they meet the highest standards of professional conduct and service. IADA Product & Services members are verified to assure the highest ethical standards and levels of experience. For more information, visit https://iada.aero.

About AircraftExchange.com

IADA's AircraftExchange marketing search portal is the only site where every aircraft listed for sale is represented by an IADA-Accredited Dealer. AircraftExchange enables users to create a confidential dashboard of business jets for sale, filtered based on their features and amenities, class size, age, and price. Users can browse through data-rich listings for available business aircraft. For more info go to https://aircraftexchange.com.

Jim Gregory for IADA

James Gregory Consultancy llc

+1 316-706-9147

email us here

Visit us on social media:

LinkedIn

Facebook

X

Other

Distribution channels: Aviation & Aerospace Industry, Business & Economy, Companies, International Organizations, Travel & Tourism Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release